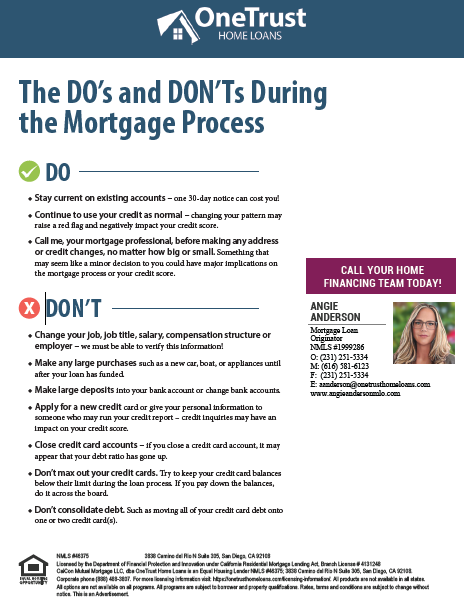

The Do’s and don’ts during the mortgage process

Navigating the mortgage process can be complex, but understanding the right moves to make and avoid can significantly impact your loan approval and overall experience. Here are the essential do’s and don’ts every prospective homeowner should follow:

DO:

Stay Current on Existing Accounts

Consistency is key in maintaining your credit score. Even a single 30-day late payment can derail your mortgage application. Always ensure you pay all bills on time.Continue Using Your Credit as Normal

Maintain your regular spending patterns. Any sudden change can be a red flag to lenders, potentially affecting your credit score negatively.Consult Your Mortgage Loan Officer

Before you make any changes to your address or credit, even seemingly minor ones, it’s crucial to consult your mortgage loan officer. What might seem inconsequential can have significant implications on your mortgage eligibility.

DON'T:

Change Your Employment Status

Stability is crucial; do not switch jobs, job titles, salary, or employer during the mortgage process. Lenders must verify stability and consistency in your employment history.Make Large Purchases

Hold off on big-ticket items like cars, boats, or expensive appliances until after your loan closes. Such purchases can affect your debt-to-income ratio and creditworthiness.Make Unusual Bank Transactions

Avoid making large deposits or changing bank accounts during your mortgage application process. Lenders scrutinize your bank statements for any irregular activity, which could raise concerns.Apply for New Credit

Every credit inquiry can potentially lower your credit score. Avoid applying for new credit cards or loans until your mortgage is fully processed.Close Credit Card Accounts or Max Out Credit Limits

Keep your existing credit card accounts open and try not to use up your full credit limit. Closing accounts or maxing out cards can appear as if your debt ratio has increased, which is a red flag for lenders.Avoid Debt Consolidation

Do not consolidate all your debts onto one or two credit cards. This can negatively impact your credit score and make it harder to manage your finances effectively during the mortgage process.

Final Thoughts

Understanding these do’s and don’ts will help you navigate the complexities of the mortgage process more smoothly. Remember, the key is stability and consistency in your financial behavior. For personalized advice and more information, feel free to reach out!